The first step to taking control of your personal finances is clearly understand what money is coming in, and where it’s going out.

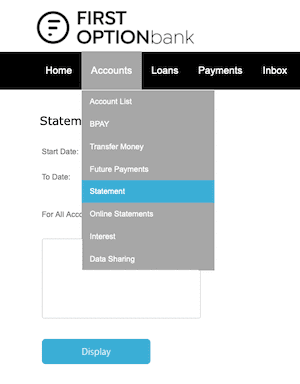

Step 1: Download your data

Go to your First Option internet banking app and download your financial data to help you focus in on where your spending is, and where savings can be made.

Now put your data into a spreadsheet like Excel, or go old-school and print it out on paper and get your highlighters out to help you focus on different types of income and expenses. Whichever way you choose to look at the data, the key is to force yourself to think about it

Identify your major expenses and create categories for them like rent/mortgage repayments, regular bills, food, phone, transport, entertainment etc.

You now have your ‘data dump’ in a digestible format and you can start looking at where you’re spending money, and where you could be saving.

This shouldn’t be a big task, it might take you just one evening and it’s time very well spent.

If you’re not looking at your income and spending data that’s fine, it’s your choice, but you may just be choosing to self-sabotage your financial life!

So, pull your finger out, download your data, put it into a manageable format, assign categories and you have completed your own Step 1 to better personal budgeting.

Watch this episode of Ticker Money with Dr Steve

Next month…. Step 2: Introducing alerts to keep track of transactions