A special savings account with big interest for small people

This dedicated high-interest savings account is just for kids, designed to help them save up for something they want. New under-18 memberships will get a kids' moneybox to help them keep coins to deposit into their new accounts.*

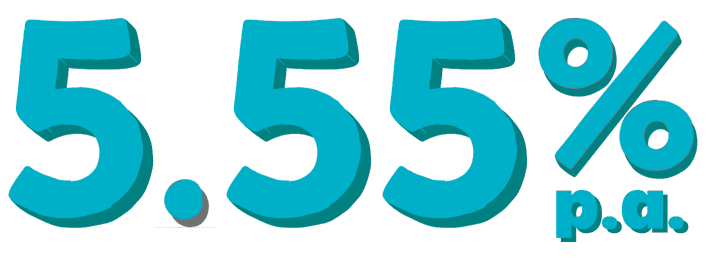

Deposit a minimum of $5 per month (that's pocket money!) without making a withdrawal and earn bonus interest up to 5.55% p.a. on balances up to $5,555.

Kids' Bonus Saver accounts can have their own PayID so parents (and grandparents!) can directly contribute to kids' savings via an email address or a mobile phone number, without needing an account number and BSB.

There's no Visa debit card attached to our Kids' Bonus Saver accounts in order to encourage good saving habits.

A linked 'everyday' account with a Visa debit card (digital and plastic) can be included in kids' memberships for pocket money management.

Kids Bonus Saver accounts can be linked to parents' internet banking so they have visibility over the savings, and spendings. Alerts can also be set up (email or SMS) for real-time notifications of deposits and withdrawals.

- To open a new Kids Bonus Saver account, the child and a parent or guardian may need to become First Option members

- No minimum initial deposit

- Variable interest rates

- Bonus interest tiered structure optimised for $0 - $5,555 balances

- Bonus interest conditions – minimum deposit of $5 per month and no withdrawals, otherwise only the base interest is earned: 0.05% per annum.

- Internet banking and Mobile Banking App access

*This special offer is available to new customers referred by RateCity and available until 31 March 2024. The Kids Bonus Saver Product is issued by First Option Bank, not RateCity. RateCity is a comparison website and does not issue financial products. Please read the Product Disclosure Statement and Target Market Determination before making a decision. If you choose to open a Kids Bonus Saver account, you will deal directly with First Option Bank, not RateCity.

Government Guarantee

Deposits in First Option Bank savings and investment accounts are insured by the Australian Government Financial Claims Scheme – up to a total of $250,000 per member. This provides you exactly the same protection as you would get from the major banks. Read more about the Deposit Guarantee on the APRA website.