Your Business Banking

Bank accounts and money-management tools specially for small Businesses, just like Yours!

Managing cash can be tricky: getting the best balance between accessibility and a good return, paying the right suppliers the right amount at the right time and making sure your own people get paid, painlessly.

Your Business Banking provides a set of tools to manage your business' money efficiently and effectively.

The Business Cash Hub is the transactional hub of the suite, providing financial functionality with the support of a team of personal bankers available to help you.*

Business Bonus Saver accounts are a perfect place to park funds where they can earn excellent interest .... whilst being accessible if you need them without notice.

Business Term Deposits allow you to lock away excess money and collect a high return on a set date: it's set and forget cash investing.

And a GST/Tax Saver account rounds out the set giving you a place to park what you need to set-aside, with the minimum of fuss and risk.

*Fees may apply for Business memberships, some product features and staff-assisted transactions if Your Business' monthly balance is less than $25,000

Talk to the team: 1300 855 675 (9am - 4:30pm, Mon-Fri)

Business Bonus Saver

High-interest savings accounts for Your Business

Earn excellent interest on your additional cash, but keep it available for if you need it. At-call balances earn 4.65% p.a. interest up to $2 million so long as you deposit a minimum of $1,000 per month.

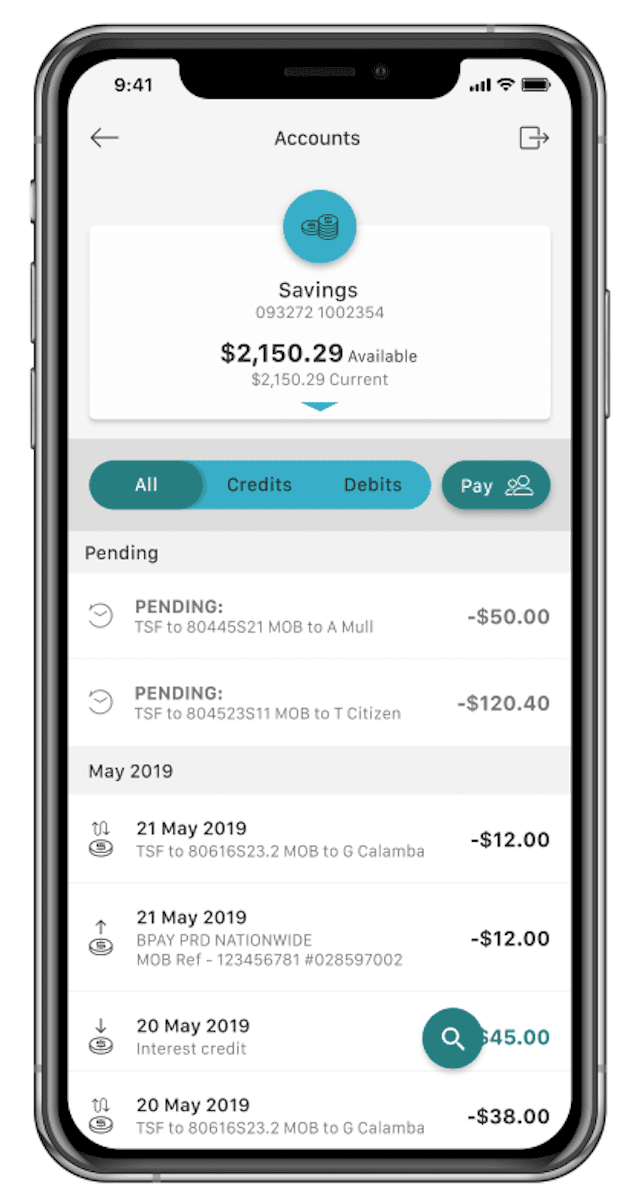

This is a high-interest online savings account so whilst you'll have online access to deposit, withdraw, transfer money to/from it... there is no Visa card access to the account.

You transfer money in... it earns high interest... you transfer it out if you need it.

If some months you don't meet the bonus interest earning requirements* you'll still get 0.5% p.a. interest on balances up to $2 million.

The Australian Government guarantees aggregated deposits of up to A$250,000 with Australian authorised deposit-taking institutions, and First Option Bank certainly is one.

*Bonus interest eligibility requirements: balance between $1 and $2,000,000, a minimum monthly deposit of $1,000 and no withdrawals

4.65%p.a.

Variable interest on at-call balances up to $2m

Features

Industry-leading interest rates on at-call balances to $2m

Internet and mobile app banking access

Deposit $1k with no withdrawals to trigger bonus interest each month

PayID for easy account identification

Business Cash Hub

Transactional accounts to manage Your Business' money

Make professional payments using Your Business' Visa card, do instant online transfers with Osko, pay your suppliers by BPay and if you need help with an important transaction... just reach out to our team for a staff-assisted transaction*.

*A small fee of $5 may apply per transaction if Your Business Banking's monthly balance is below $25k.

Visa debit card linked to Your Business' Cash Hub

PayID for easy account identification

Monthly statements: free online or paid on paper

Osko, BPay, eftpos, PayID, PayTo and standard transfers

Internet banking and mobile apps to manage Your Business' money

Member Service support teams in Sydney and Melbourne

Bank@Post for all in-person transactions

Business Term Deposits

Highest-interest options to lock away some surplus funds

Term deposits often offer the best possible interest earning potential for your excess money. Lock away funds you don't need now for a fixed period between 3 months and 2 years and get great rates. You can access it mid-term if you really need to... but that will usually cost you some (or all) of the interest earned.

There are no fees to set-up a term deposit or at the conclusion of the term when you can roll it over for a new term, with your earned interest, or move it into a Business Bonus Saver account to keep it 'at-call'.

4.90%

Interest on a 12 month standard deposit of $250,000 or more